This post may contain affiliate links, and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Amid the current financial turmoil in the United States, characterized by tariffs, layoffs, a challenging job market, significant 401(k) losses, rising inflation, and overall economic uncertainty, we believe this is an ideal moment to compile some of the most effective tools available for managing your budget. Whether you’ve been navigating these challenges and are looking to become more organized with your spending and saving, or if a significant life change has prompted a reevaluation of your financial situation, we encourage you to explore these valuable resources!

In previous articles, we have shared our top recommendations for financial books aimed at beginners. Today, however, we are focusing on exceptional books and apps that specifically teach you how to effectively budget your finances. We invite you to share your favorite tools and resources in the comments section below!

While many of the books listed below may not be the latest releases, the fundamental budgeting tips they provide remain relevant and applicable over time. For those seeking immediate insights into the financial struggles that Americans are facing, we recommend reading this informative article from The Wall Street Journal on making prudent financial decisions, as well as this Washington Post piece about adjusting your shopping habits in response to economic pressures.

related: tales from the wallet: how to make a budget

related: not sure what to do first/next in your personal finance journey? here’s our money roadmap

Top Resources for Effective Budget Management: Essential Books

You Need a Budget: A Comprehensive Guide to Financial Freedom

You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse Mecham (2017)

[Amazon / Bookshop]

It comes as no surprise to the fans of the renowned YNAB tool and Corporette readers that we have featured this book, as it has become a classic in the realm of personal finance. If you are new to budgeting or have struggled with keeping your spending and savings organized, the strategies outlined in this book will help you simplify and enhance your financial management.

Mecham, the visionary behind his personal finance company and the YNAB tool, penned this book to assist readers in transforming their relationship with money while alleviating financial stress. He presents four clear-cut rules designed to empower readers: (1) Give Every Dollar A Job, (2) Embrace Your True Expenses, (3) Roll With The Punches, and (4) Age Your Money. Each principle serves as a stepping stone toward achieving financial stability and peace of mind.

To discover more about the associated YNAB tool, a beloved system among readers, continue reading below!

The One Week Budget: Master Your Finances in Just Seven Days

The One Week Budget: Learn to Create Your Money Management System in 7 Days or Less! by Tiffany Aliche, “The Budgetnista” (2011)

[Amazon / Bookshop]

If you find yourself pressed for time and unable to dedicate extensive hours to mastering budgeting principles or reading lengthy personal finance texts, The One Week Budget by The Budgetnista is an excellent choice.

This succinct yet informative guide provides straightforward instructions on how to budget effectively by meticulously tracking every dollar spent. It includes practical forms and relatable examples, making it suitable for adults and teenagers alike—reflecting Aliche’s witty sense of humor throughout the text.

This book is particularly beneficial for recent graduates or individuals embarking on their first professional journey. (Additionally, we have compiled top financial tips tailored for women entering high-paying roles.) However, be aware that some reviewers note that the process may realistically take longer than the “one week” suggested, as it requires time to gather data on your spending habits.

Aliche has also authored various other financial guides (including one aimed at children), made appearances in a Netflix financial literacy show, and hosted a PBS special titled “Get Good With Money.” She also runs a popular blog and offers an online course.

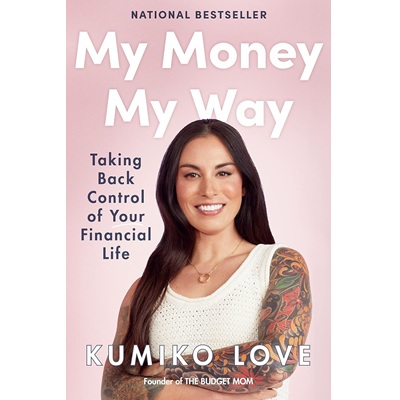

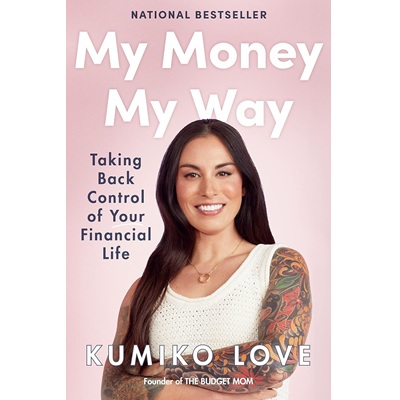

My Money My Way: Reclaiming Control Over Your Financial Future

My Money My Way: Taking Back Control of Your Financial Life by Kumiko Love (2022)

[Amazon / Bookshop]

Kumiko Love, the author of My Money My Way, is also the creator of The Budget Mom, which provides a variety of resources including podcasts, budgeting systems, courses, and more. This book is designed for all women, whether they are mothers or not. Love has impressive credentials, having paid off a staggering $78,000 in debt and purchased a home outright. She is also a certified financial counselor.

If a personal finance expert features eye-catching tattoos on the cover of her book, it’s likely that her writing style will be relatable and engaging. Love’s writing emphasizes the importance of aligning your emotional health with your financial health, a concept that many individuals struggle with as they navigate their financial journeys.

This book aims to help readers identify their spending patterns, make informed decisions, and develop a robust budget. Your purchase includes a comprehensive reading guide, six informative video lessons, and a “financial fulfillment checklist,” all accessible through The Budget Mom website.

related: the best personal finance resources from professionals

Essential Mobile Applications for Effective Budget Management

You Need a Budget App: Your Personal Finance Companion

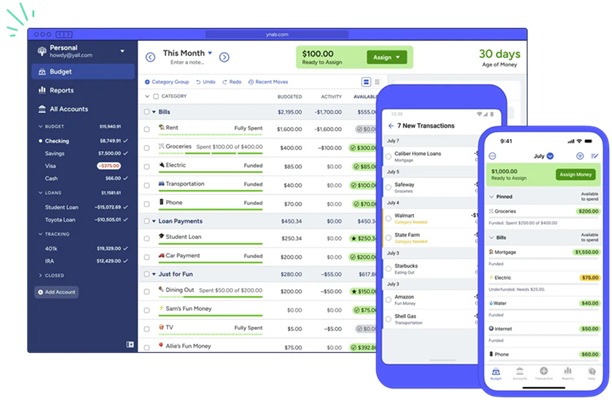

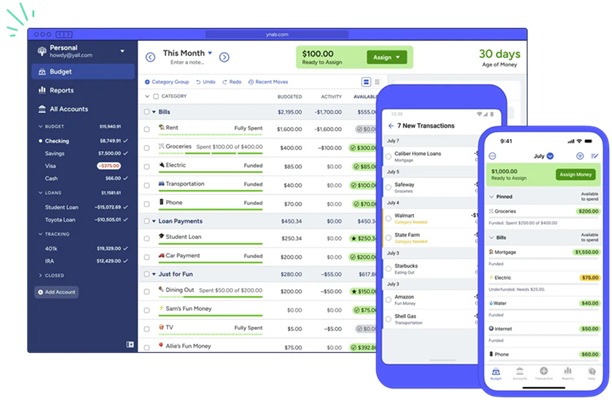

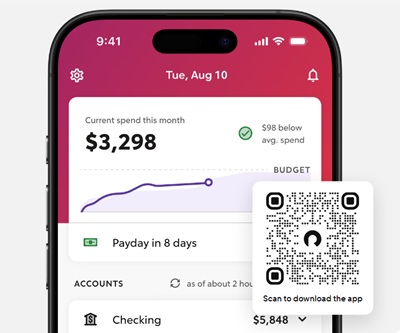

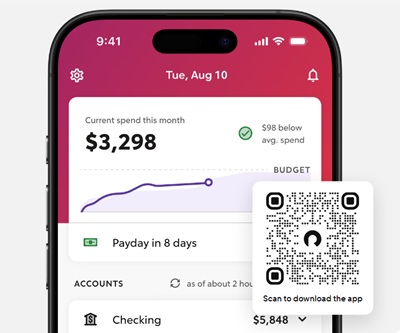

The YNAB app has gained immense popularity as a personal finance tracker, boasting a loyal following among users. Its website asserts that it teaches individuals to “give every dollar a job,” “fund your wildest dreams,” “define priorities,” and steer spending decisions towards the life you desire, encouraging you to “live spendfully.” (While the term “spendfully” may raise eyebrows, the app’s value is undeniable.)

In addition to the standard features typical of a budgeting app, YNAB offers several unique capabilities worth noting: syncing across all devices, participation in community challenges, goal tracking, insightful reports, assistance with debt management, and the option to share your subscription with others. Furthermore, YNAB provides free Q&A sessions, informative workshops, a blog, and a vibrant online community to support users.

YNAB offers a generous 34-day free trial without requiring credit card information upfront. After the trial, subscription fees are $109 per year (approximately $9.08 per month) or $14.99 per month for a more flexible plan. Be sure to check out our guide for getting started with the app.

related: 3 great online personal finance classes

Rocket Money: Simplifying Your Financial Life

Recently, I’ve been hearing positive feedback about Rocket Money (and not just from their podcast advertisements!). This app boasts features that set it apart from YNAB, particularly in managing bills and identifying unnecessary subscription services that we often forget about. (For instance, am I really getting my money’s worth from my Scientific American subscription? Probably not.)

Rocket Money consolidates your subscriptions into one accessible location, and its “concierge” service can even assist in canceling them for you—how convenient! It also enables users to track their spending, monitor net worth, and manage bills, all in an effort to save more and reduce unnecessary expenses. Additionally, it provides guidance on saving habits to help you reach your financial goals, features handy phone widgets, offers a free credit score, and even negotiates your bills (for an additional fee). The website also hosts free personal finance resources for both members and non-members.

While Rocket Money is free to use, a premium membership with enhanced features is available for $6 to $12 per month, and users can sign up for a 7-day free trial (which is considerably shorter than YNAB’s trial period!).

related: money challenge: review your renewing subscriptions

Final Insights on Budgeting: Tips and Resources

- I recently experimented with Quicken Simplifi for a short duration (RIP Mint), but I found it didn’t offer anything particularly unique compared to the two applications mentioned above. Your experience may vary, as Wirecutter once rated it as the best budgeting app. It costs $5.99 per month, but I managed to secure a one-year subscription for $38 during a promotional sale earlier this year.

- For more in-depth information and varied opinions on budgeting systems, consider visiting Reddit, particularly subreddits like r/personalfinance, r/financialplanning, and r/budget. Many personal finance subreddits feature helpful wikis as well.

- If you’re in search of budget spreadsheets without the hassle of creating your own, Etsy is a great place to explore, though it may require a small investment. I recently purchased a template for $5, but it appears to have spiked to $26 during a sale (?!). Microsoft 365 also offers a selection of free budget templates, and don’t hesitate to reach out to a financially savvy friend to see if they can share a simple template with you. I did this and received a straightforward and effective one!

Readers, we would love to hear your budgeting tips and favorite tools and books! Additionally, does anyone still utilize PAPER for tracking finances, whether through a personal system or free online printables? I’m feeling a bit tempted to try it out.

Stock photo via Stencil.