The Help Independent Tracks Succeed (HITS) Act, a significant legislative advancement aimed at empowering musicians, has successfully passed through Congress as part of President Trump’s tax and spending cuts bill on Thursday, July 3. This groundbreaking legislation allows artists to deduct 100% of their production expenses in the year they are incurred, offering crucial financial relief. The achievement was quickly celebrated by Harvey Mason jr., the CEO of the Recording Academy, which has been a vocal advocate for the enactment of this transformative bill.

Originally co-sponsored by Rep. Linda T. Sánchez (D-Calif.) and Rep. Ron Estes (R-Kansas), the HITS Act was first introduced during July 2020, amidst the unprecedented challenges posed by the COVID-19 pandemic that severely impacted many musicians due to widespread shutdowns across the United States. A companion bill was introduced in the Senate in December of the same year by Senators Dianne Feinstein (D-Calif.) and Marsha Blackburn (R–Tenn.). After being omitted from several legislative packages, it was reintroduced in the Senate in January, ultimately being integrated into the Trump-endorsed One Big Beautiful Bill Act, which now awaits only the president’s signature to become law.

“The Recording Academy is immensely proud to have collaborated with Reps. Estes and Sánchez and Senators Blackburn and Cortez Masto over the years to bring the HITS Act to fruition, and we are profoundly grateful for their steadfast support,” Mason expressed in an official statement. This collaboration highlights the concerted efforts of various stakeholders in the music industry to advocate for policies that benefit artists and foster a more sustainable creative environment.

Mason also commended the removal of an additional component of the Republican-led bill: a clause that would have imposed a ban on state-level AI protections for a decade. This development reflects a growing awareness within the legislative framework regarding the implications of artificial intelligence on the creative sectors.

“As the music industry navigates the rapid technological advancements and an evolving musical landscape, this moment signifies a notable stride towards safeguarding creators and nurturing a vibrant music ecosystem,” Mason further articulated. He added, “We extend our gratitude to Senators Blackburn and Cantwell for their insightful leadership in eliminating the AI provision that could have posed significant threats to the creative community. This represents a substantial victory for those who create music and for the future of the music industry itself.”

The HITS Act, which necessitates a modification of the tax code, permits musicians to fully expense the costs associated with new studio recordings up to $150,000 in the year they are produced. This is aimed at alleviating the financial pressures faced by creators. Under the current tax regulations, producers and artists are required to amortize production expenses for tax purposes over the economic lifespan of a recording, which typically spans three to four years, creating a substantial delay in financial benefits for artists.

“We aimed to incentivize musicians to return to the studio and release more music when it is most needed, while also providing them with immediate financial advantages through this first-year deduction,” stated Daryl Friedman, the then-chief advocacy officer of the Recording Academy, in an interview with Billboard when the bill was initially introduced in the House of Representatives. “This will not only serve as an ongoing tax provision beyond the pandemic but will also provide lasting benefits to artists for many years to come.”

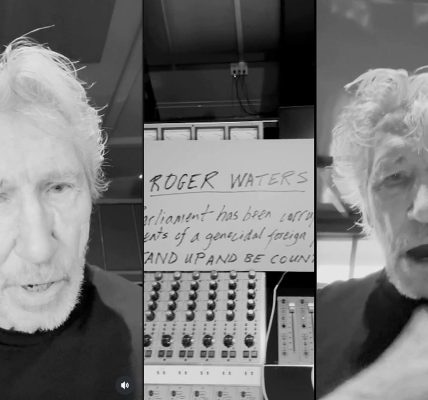

Here you can find the original article; the photos and images used in our article also come from this source. We are not their authors; they have been used solely for informational purposes with proper attribution to their original source.