This post may include affiliate links, and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

The well-known personal finance tool Mint officially ceased operations in 2024, leaving many users searching for suitable alternatives. Though I haven’t extensively researched potential replacements, I can empathize with those facing this challenge. In this article, we will explore some of the best Mint alternatives available to help you manage your finances effectively.

If you previously relied on Mint, what app or tool have you transitioned to? How does it compare in terms of functionality and user experience?

A few months back, we highlighted five excellent tools for managing your budget, including some insightful literature on financial management. Today, however, we will delve deeper into specific apps, recognizing that online personal finance tools warrant dedicated exploration. The applications listed below offer more than just budgeting capabilities; they provide comprehensive financial tracking options!

related: how much do you keep in your checking account?

Explore Top Alternatives to Mint for Comprehensive Money Tracking

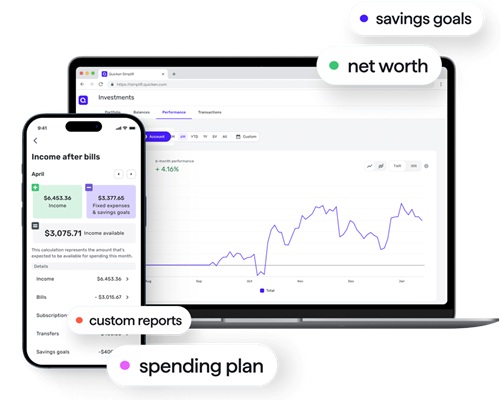

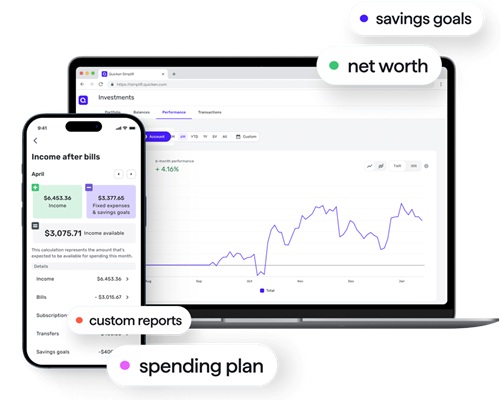

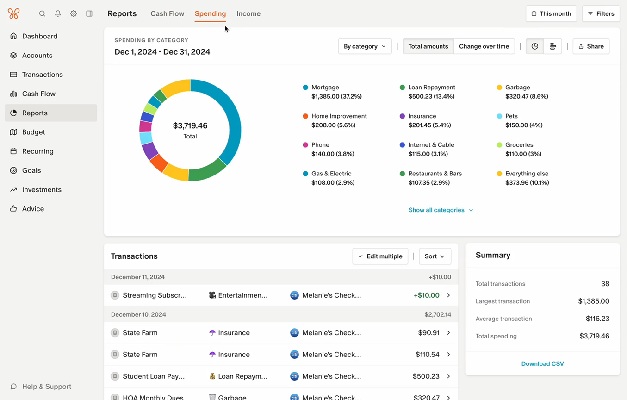

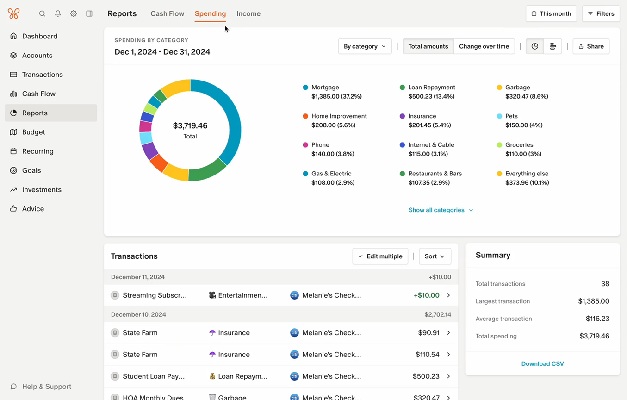

Discover Quicken Simplifi for Simplified Financial Planning

Quicken Simplifi is more than just a basic financial management tool; it empowers users to craft a detailed spending plan for the month ahead. With features that allow you to establish custom savings goals, create virtual savings accounts to track your progress, link your investment accounts, and develop a watchlist to manage your spending by payee, category, or tag, it transforms the way you handle your finances. Additionally, the newly introduced retirement planning feature enables you to simulate various scenarios to gauge their impact on your future savings.

Stay informed about your upcoming bills with timely email notifications regarding due dates or confirmations that a bill has been paid—though you can disable these alerts if preferred. To add an element of fun, Quicken Simplifi incorporates gamification, allowing you to earn badges for achievements such as connecting accounts, avoiding overspending, paying bills punctually, and reaching your financial goals. An online community is also available for users to engage and share insights.

While the standard subscription to Simplifi is $5.99/month, a summer promotion allows you to enjoy a discounted rate of just $2.99 when billed annually.

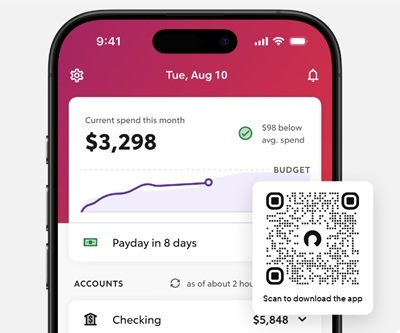

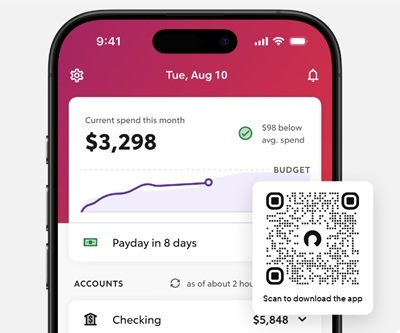

Experience Rocket Money for Streamlined Budgeting

Here’s a brief overview of Rocket Money from our previous discussion:

Rocket Money has been garnering positive reviews recently (and not solely from their podcast advertisements!). It offers unique features that set it apart from YNAB, particularly in the realm of bill management and tracking unnecessary subscription services that many of us accumulate. For instance, am I really getting enough value from my Scientific American subscription to justify its cost? Certainly not!

This innovative app consolidates your subscriptions into a single view, and its “concierge” service can even handle cancellations for you, which is incredibly convenient. Furthermore, Rocket Money enables you to monitor your spending, net worth, and bills, all with the goal of promoting smarter saving habits and minimizing expenses. You can also customize widgets on your phone, access your free credit score, and utilize their bill negotiation service (for a fee). The website offers free personal finance resources for both members and non-members, and Rocket Money also has a credit card option available.

While the basic version of Rocket Money is free, users can opt for a premium subscription that ranges from $6 to $12 per month. A free 7-day trial is also available, though it’s shorter compared to YNAB’s trial period.

related: 3 great online personal finance classes

Utilize Monarch Money for Comprehensive Budgeting Solutions

Monarch Money stands out with its robust budgeting, tracking, and planning features designed to enhance user experience. A key highlight is its collaborative tools aimed at couples who wish to manage finances together. For example, one partner can flag transactions for the other to review, fostering transparency and teamwork.

Beyond basic functionalities, Monarch Money allows users to link an unlimited number of accounts and integrates with external platforms such as Coinbase, Zillow Zestimates, vehicle valuation tools, and Apple Card. The app effectively monitors your subscriptions and offers two distinct budgeting systems, alongside goal tracking, customizable reports, and AI-assisted categorization of transactions (which users can adjust as necessary). Additionally, the Flex Budgeting feature provides increased adaptability to meet changing financial needs.

Monarch Money claims to interface with more financial institutions than any other platform, although manual entry for tracking is also available.

The pricing structure for Monarch Money is $8.33/month (billed at $99.99 annually) or $14.99 for a monthly plan. Currently, new users can enjoy a 30% discount on their first year, and the company offers a “no-questions-asked money-back guarantee” for those who decide it’s not the right fit.

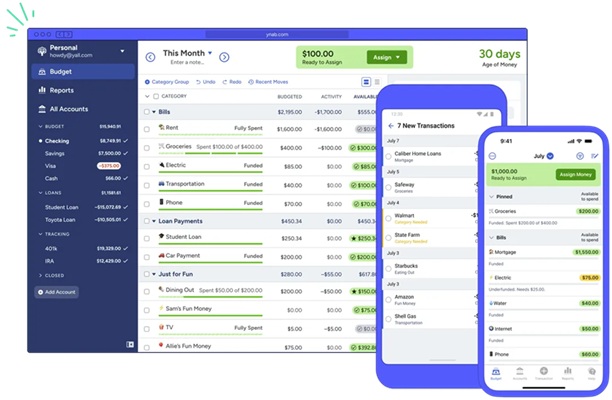

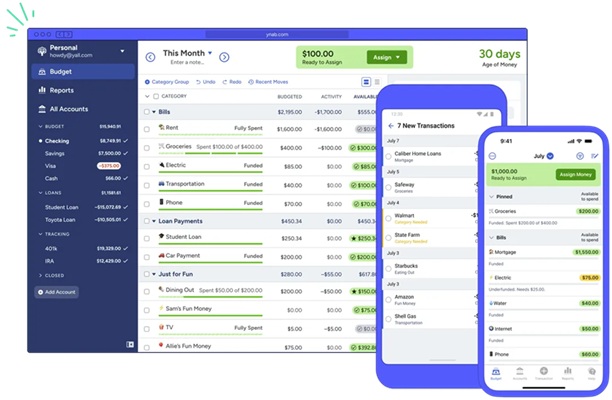

Maximize Your Budgeting with You Need a Budget (YNAB)

Here’s a summary of what makes YNAB a favorite among our readers:

YNAB, or You Need a Budget, has earned a loyal following as a powerful tool for personal finance tracking. Its website claims to help users “give every dollar a job,” “fund your wildest dreams,” “define priorities and guide spending decisions toward the life you want,” and to “live spendfully.” (Admittedly, the term “spendfully” might be off-putting to some, but the app itself remains highly effective.)

In addition to standard features, YNAB offers all-device syncing, community challenges, goal tracking, insightful reports, debt management assistance, and the ability to share your subscription with others. Online, YNAB provides free Q&A sessions, workshops, a blog, and a community for users to connect and share tips.

YNAB provides a free 34-day trial without requiring credit card information upfront. After the trial, users can choose between an annual fee of $109 (approximately $9.08/month) or a monthly plan at $14.99. Here’s a helpful guide to getting started with the app.

Leverage NerdWallet for Accessible Personal Finance Management

NerdWallet is known for its diverse range of personal finance resources, including a free personal finance app that collaborates with Atomic Invest to offer enhanced features for users. This app is particularly beneficial for personal finance novices who may not require extensive functionalities.

To start, the app includes investing options like a Treasury account through Atomic Invest, which offers a competitive 4.18% APY, along with an Automated Investing account. Additionally, reflecting NerdWallet’s mission, the app incorporates financial education content along with staff ratings and reviews for credit cards, bank accounts, and loans.

Unfortunately, the website provides limited details about other features, as this tool is relatively straightforward and free. However, it serves as an excellent entry point for those new to personal finance management.

related: money challenge: review your renewing subscriptions

Readers, please share your favorite Mint alternatives for tracking your money! Have you tested any of these tools?