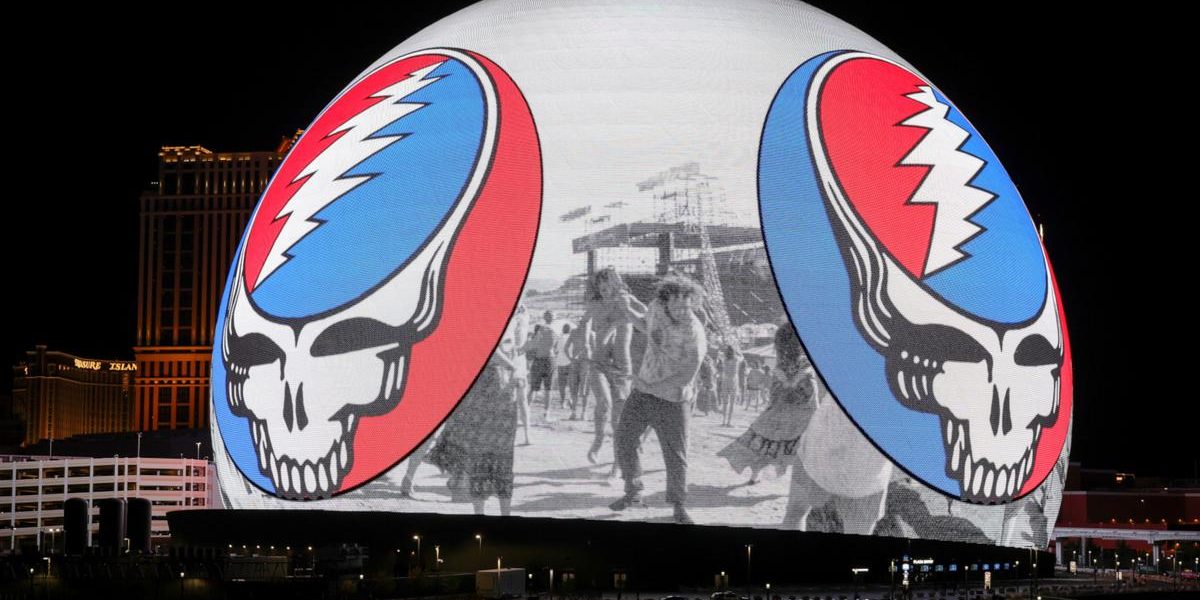

Since its launch in September 2023, the Sphere in Las Vegas has redefined the live concert experience, setting new standards that leave audiences in awe. This spectacular venue combines cutting-edge technology with breathtaking visuals and world-class audio systems, creating an unparalleled atmosphere for music lovers. UCR writers have attended several performances at this innovative site, featuring legendary artists like U2, Dead & Company, and the Eagles. Each event has garnered enthusiastic reviews, highlighting the venue’s potential to host a diverse array of performances, showcasing its remarkable versatility.

Despite the buzz surrounding this cutting-edge location, questions arise about its financial stability. The complexities of big business often obscure the underlying issues that contribute to such challenges. The financial landscape surrounding the Sphere is intricate, raising curiosity about how a venue with such promise could encounter monetary difficulties.

Understanding the Sphere’s Enormous Financial Commitment

The Sphere has been operating at a financial loss since before its breathtaking exterior lights were illuminated, and the reasons extend beyond mere electricity costs. The construction of this architectural masterpiece spanned five years, from 2018 to 2023, culminating in a staggering price tag of $2.3 billion, making it the most expensive concert venue ever built. Even amid the excitement of its opening, navigating out of such a significant financial deficit is an uphill battle for its management.

Critics have scrutinized the Sphere’s business model, noting that while concerts are its primary attraction, the venue primarily caters to a limited range of artists. Designed for extended residencies, it does not present a feasible option for bands seeking to book a few shows as part of a broader tour. Although the roster of musicians capable of selling out multiple shows is impressive, it remains relatively small, which may hinder the venue’s profitability.

READ MORE: U2’s Groundbreaking Sphere Residency: By the Numbers

In response to these challenges, the Sphere has diversified its offerings beyond concerts, hosting various events, including sporting activities, immersive films, and high-profile corporate events. Additionally, the venue has generated substantial revenue through advertising, capitalizing on its iconic exoskeleton, which is recognized as one of the most striking displays globally.

Despite these advancements, Sphere Entertainment, the parent company of the venue, still faces significant financial hurdles. A report in February 2025 revealed that the company was grappling with $1.5 billion in debt. Furthermore, Sphere Entertainment reported an operating loss of $142.9 million for the first quarter of 2025, a figure that, while still alarming, showed slight improvement compared to the same period in 2024.

Recently, there have been indications that public interest in the Sphere may be diminishing. Concert tickets, which were once highly coveted, are now frequently available on the day of the show. Additionally, prices for the Sphere Experience, an immersive attraction linked to the screening of Darren Aronofsky’s film Postcard from Earth, have decreased from $119 to $99. While some decline in interest is typical for any heavily promoted project, the question remains: can the Sphere sustain a drop in ticket sales?

Examining the Financial Struggles of MSG Networks and Its Impact on Sphere

Sphere Entertainment operates two distinct business units: the Las Vegas venue and MSG Networks. While the Sphere is under scrutiny for its long-term viability, MSG Networks is entrenched in its own financial difficulties, further complicating the situation.

READ MORE: 5 Stunning Moments From Eagles’ Sphere Opening Night

For many years, MSG Networks flourished as a regional sports network serving the Mid-Atlantic region, showcasing major teams such as the New York Knicks, New York Rangers, New York Islanders, Buffalo Sabres, and New Jersey Devils. However, like many regional sports networks, it has faced significant challenges due to cord-cutting and league-wide agreements favoring national broadcasts. As a result, MSG Networks’ revenue has steadily declined, leaving it with over $800 million in debt.

“If MSG Networks is unable to successfully negotiate a refinancing or restructure its debt, there is a high probability that MSG Networks and/or its subsidiaries may seek bankruptcy protection, or that lenders may move to foreclose on the collateral securing the credit facilities,” Sphere Entertainment stated during its quarterly earnings call.

Since MSG Networks operates as a separate entity, creditors cannot claim against the Sphere, even though both share a common parent company. Some analysts suggest that the Sphere might recover more swiftly if it could divest itself from the financial burdens associated with MSG Networks.

Exploring the Future Prospects of the Sphere

Despite certain warning signs, operations at the Sphere continue as usual. Executive Chairman and CEO James Dolan remains optimistic about the venue’s prospects, asserting that there are more artists eager to perform than available dates. In addition to ongoing performances from the Eagles and Dead & Company, rumors suggest that pop sensation Harry Styles may soon announce a residency at the Sphere.

Moreover, plans for a second Sphere are already underway in Abu Dhabi, although details remain vague and no official groundbreaking date has been set. Additionally, Sphere Entertainment is reportedly considering the development of smaller Sphere venues designed to accommodate around 5,000 attendees, which is significantly smaller than the flagship Las Vegas location.

Get Ready for the 2025 Rock Tour: Exciting Sneak Peeks Ahead