Music stocks have shown a remarkable recovery, outperforming major U.S. indexes for the second consecutive week following the significant disruptions caused by President Trump’s tariff policies. This resurgence indicates a resilient market that is adapting to external challenges, demonstrating the unique dynamics of the music industry amidst broader economic fluctuations.

The 20-company Billboard Global Music Index (BGMI) experienced a noteworthy increase of 3.6%, reaching a value of 2,446.90. This marks its second consecutive week of gains, a stark contrast to the previous week when it faced an 8.2% decline. Out of the 20 companies represented, 14 recorded positive gains, with five of those achieving increases exceeding 5%. The performance of larger companies significantly influenced the index’s overall value, while the four companies that performed the worst were the smallest in terms of market capitalization.

The BGMI’s performance surpassed that of both the Nasdaq and S&P 500, which saw declines of 2.6% and 1.5%, respectively. However, it fell short of the FTSE 100, which demonstrated a robust improvement of 3.9%. In addition, South Korea’s KOSPI composite index gained 2.1%, while China’s SSE Composite Index showed a modest rise of 1.2%. These indexes highlight the varying performance of global markets in response to economic conditions.

Streaming companies emerged as strong performers this week, with analysts projecting that they are particularly well-positioned to weather the effects of the U.S. tariff policies. Notably, Cloud Music led the charge with an impressive gain of 10.5%, reaching 156.40 HKD ($20.15). Following closely, Deezer secured the position of the third-best performer with a gain of 6.7%, further emphasizing the resilience of streaming platforms in the current economic landscape.

Spotify, recognized as the most valuable company in the music industry, saw its stock rise by 5.6% to $574.25. In a recent analysis, UBS revised its price target for Spotify, lowering it from $690 to $680, yet maintained a positive buy rating. Meanwhile, Tencent Music Entertainment experienced a modest uptick of 0.4%, accumulating a total gain of 10.2% in 2025, showcasing its steady growth amid market fluctuations.

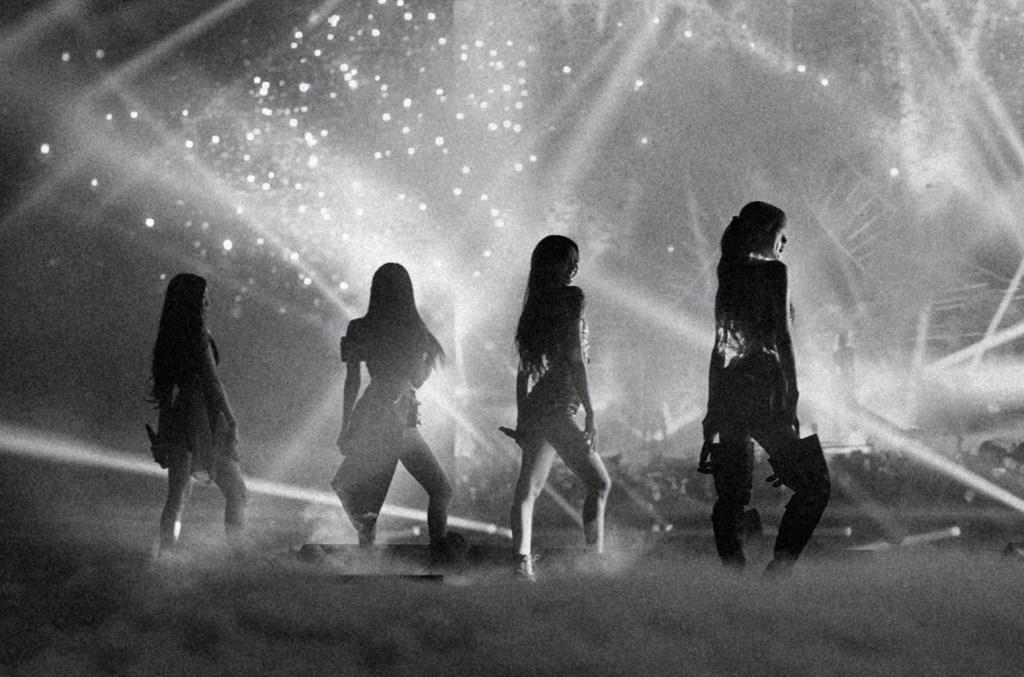

Companies operating across multiple sectors, especially those based in South Korea, also reported strong performances. YG Entertainment surged by 10.0%, reaching 66,800 KRW ($47.10). Similarly, SM Entertainment recorded a 9.3% increase to 116,300 KRW ($81.99), while JYP Entertainment improved by 6.2%, reaching 63,300 KRW ($44.63). Additionally, HYBE saw a rise of 2.0%, bringing its stock to 230,500 KRW ($162.51), indicating a healthy interest in K-pop and related entertainment ventures.

Universal Music Group experienced a 3.2% rise, bringing its share price to 23.96 euros ($27.25), turning a previous deficit into a slight year-to-date gain of 0.2%. On the other hand, Warner Music Group saw a marginal increase of 0.3%, though its year-to-date loss stands at 6.1%, illustrating the varied challenges faced by these major players in the music industry.

The performance of live entertainment companies exhibited mixed results this week. CTS Eventim, a prominent German promoter, saw a gain of 4.2%, bringing its share price to 97.20 euros ($110.54). Meanwhile, MSG Entertainment rose by 1.2%, reaching $30.69. Conversely, Live Nation experienced a decline of 1.8%, with shares dropping to $127.22. Furthermore, Sphere Entertainment Co. faced a significant drop of 6.3%, bringing its stock price down to $25.38, reflecting ongoing struggles in the live entertainment sector, especially for companies connected to large venues.

Challenges continued for radio companies, as evidenced by the decline of iHeartMedia, which fell by 14.8%, resulting in a staggering year-to-date loss of 54%. In a similar vein, Cumulus Media faced a significant drop of 19.4%, pushing its year-to-date deficit to 67.5%. This trend underscores the pervasive difficulties encountered by radio broadcasters in a rapidly evolving digital landscape.

The ongoing theme of tariffs remained prevalent in the financial landscape this week. Major technology companies, including Apple, which import essential products like phones, computers, and chips from China and other Asian nations, received temporary relief from the most burdensome tariffs. This announcement, made on April 11, resulted in a 2% increase in Apple’s stock on Monday (April 14), pushing its market capitalization back over the $3 trillion mark. However, on Thursday, the Trump administration introduced new fees on Chinese-made ships entering U.S. ports. Some of these fees were later retracted, particularly for vessels traveling between U.S. ports or from domestic ports to Caribbean islands or U.S. territories, highlighting the complexities of trade policy.